Understanding Average Prices:

Average price refers to the mean price of an asset or security observed over some period of time. It is calculated by finding the simple arithmetic average of closing prices over a specified time period.

Average price is calculated by taking the sum of the values and dividing it by the number of prices being examined.

Average total cost is calculated by dividing the total cost of production by the total number of units produced.

Types of Average Prices:

There are several methods to calculate average prices, each with its own merits and applications. Here are three commonly used approaches:

-

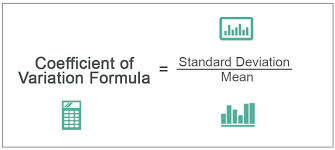

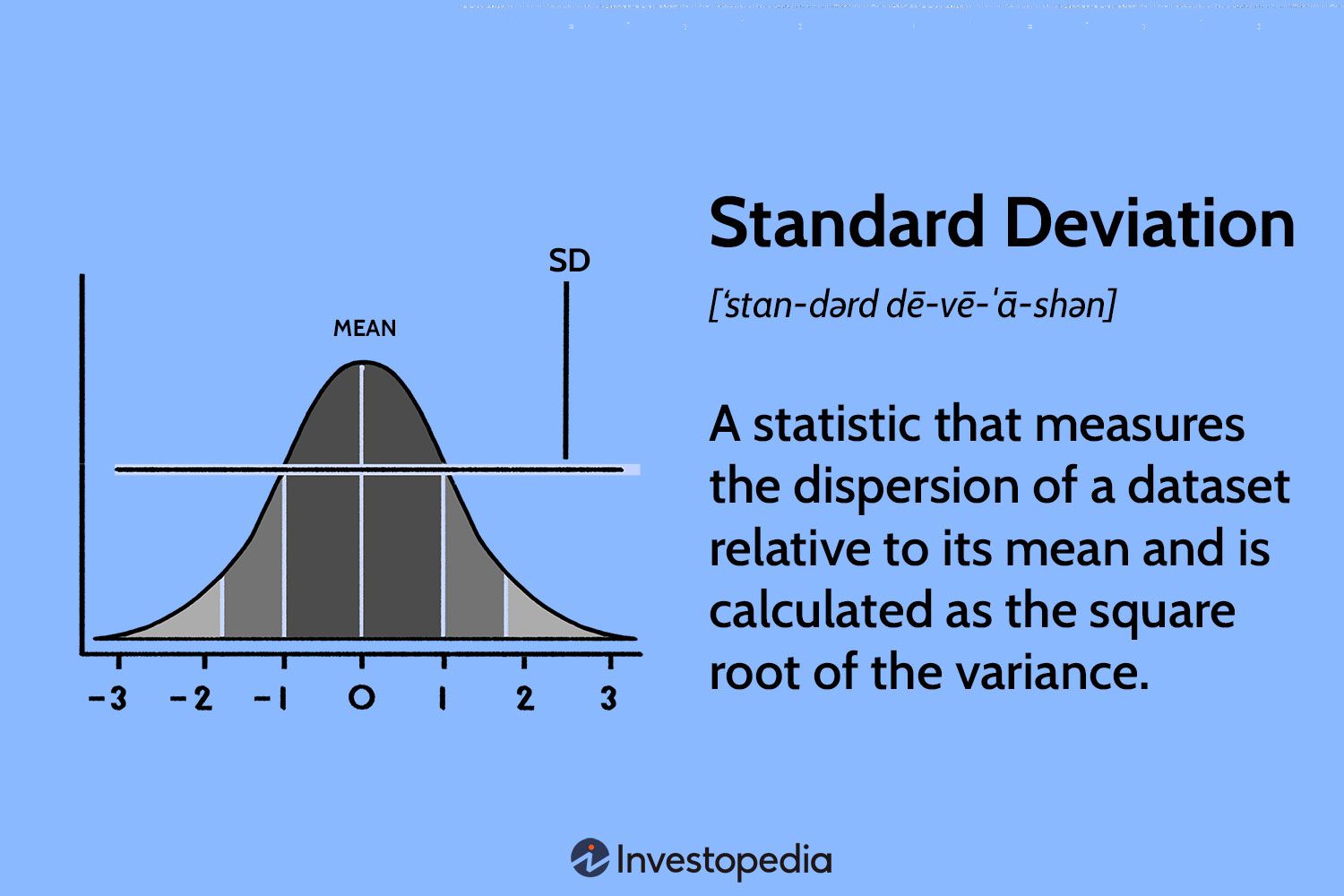

Arithmetic Mean: The arithmetic mean is the most straightforward and commonly used method of calculating average prices. It is obtained by summing up all the prices in a dataset and dividing the total by the number of prices. The formula for the arithmetic mean is:

Average Price = Sum of all prices / Number of prices

For example, if we have a set of prices {10, 15, 20, 25, 30}, the average price would be (10+15+20+25+30) / 5 = 20.

-

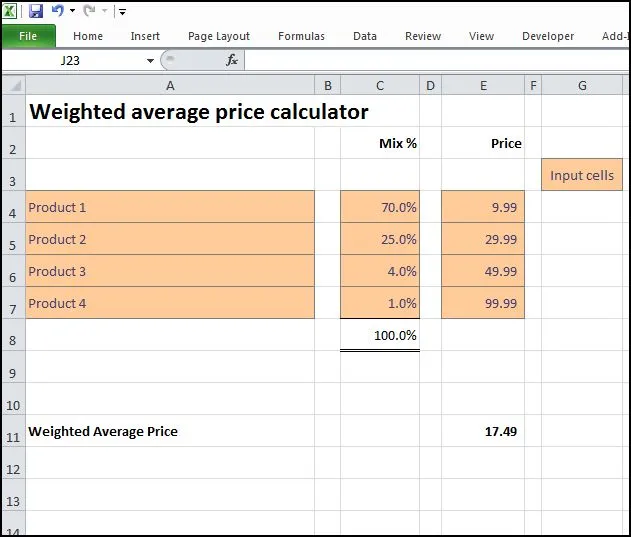

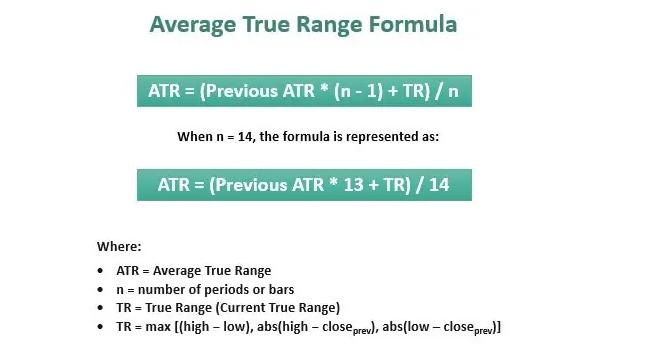

Weighted Average: In certain scenarios, assigning weights to prices can provide a more accurate representation of the average. This method is known as a weighted average. Weighted averages give more importance or significance to certain prices based on predetermined criteria. For instance, in financial markets, stocks with higher market capitalization may have a higher weight in the average calculation..

VWAP= ∑Price * Volume/∑Volume

Practical Applications:

Average price calculations find extensive applications in various domains:

-

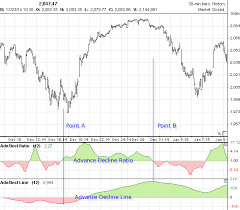

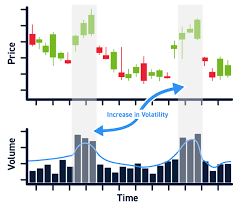

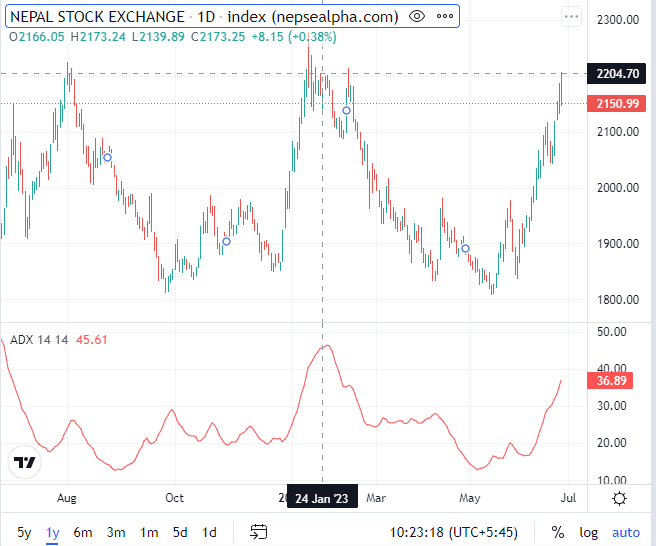

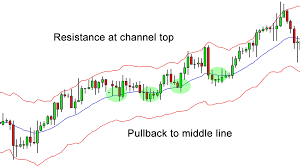

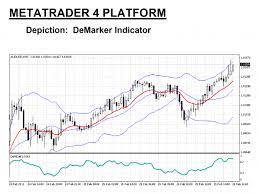

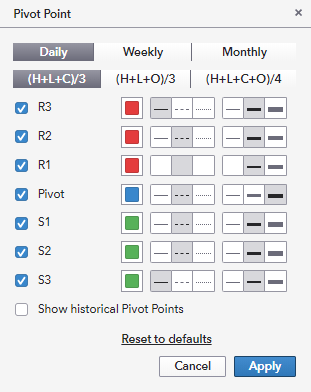

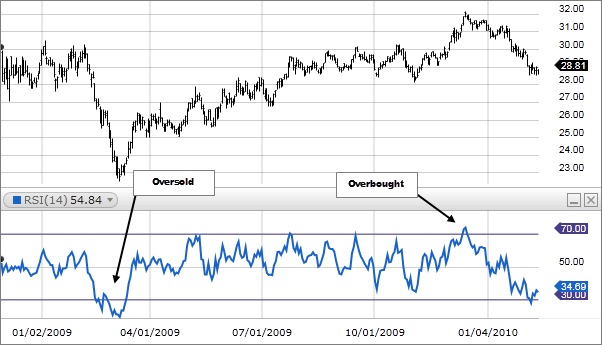

Financial Analysis: Investors and traders use average prices to identify trends, determine buying or selling opportunities, and gauge the overall market sentiment. Moving averages, such as the 50-day or 200-day moving average, are frequently used in technical analysis to identify potential support and resistance levels.

-

Business and Pricing Strategies: Business owners rely on average price calculations to set competitive prices for their products or services. Analyzing average prices of similar products in the market helps determine a fair and profitable pricing strategy. It also aids in evaluating pricing trends over time and making informed decisions regarding discounts, promotions, or price adjustments.

-

Economic Indicators: Average price calculations play a vital role in measuring inflation rates and consumer price indexes (CPI). Governments and central banks closely monitor average prices across various sectors to assess the overall economic health of a nation. This data helps policymakers make informed decisions regarding monetary policy and fiscal measures.

4. Portfolio Management: In investment portfolios, average price calculations help investors track the performance of their holdings. By calculating the average price at which different securities were acquired, investors can determine the average cost basis of their investments. This information is crucial for assessing the profitability of a portfolio and making decisions on buying, selling, or rebalancing assets.

-

Cost Analysis: Average price calculations are essential in cost analysis for businesses. By calculating the average cost of raw materials or production inputs, companies can evaluate their cost structures and identify areas for cost optimization. This information helps in budgeting, pricing decisions, and negotiating with suppliers.

-

Consumer Behavior Analysis: Average price calculations are valuable in studying consumer behavior and purchasing patterns. Retailers and marketers analyze average prices to understand price sensitivity, identify price thresholds, and develop effective pricing strategies. It also aids in identifying price premiums for premium products or price-sensitive segments of the market.

Conclusion: Understanding and calculating average prices is a powerful tool for making informed decisions in finance, economics, and business. Whether you are an investor, business owner, or analyst, mastering the art of average price calculations allows you to extract valuable insights from complex datasets. By harnessing the power of averages, you can identify trends, forecast future outcomes, and make well-informed choices that drive success in your endeavors.Average price calculations are not just numbers; they hold significant insights and provide a quantitative basis for decision-making. Whether you're an investor, business professional, economist, or researcher, understanding and utilizing average price calculations can give you a competitive edge. By applying different methods and analyzing average prices, you can gain a deeper understanding of trends, patterns, and market dynamics, leading to more informed and strategic actions. Mastering the art of average price calculations opens doors to new opportunities and better outcomes in your endeavors.