Understanding Moving Average Crossover

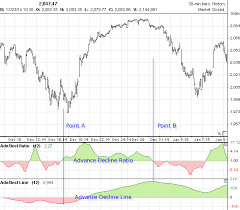

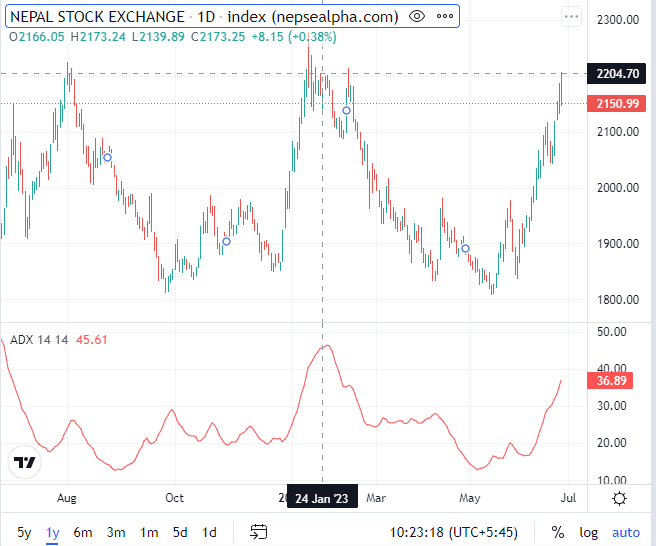

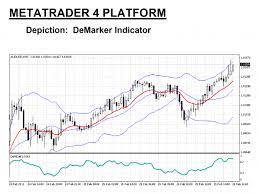

Moving Averages are a fundamental tool in technical analysis, helping traders smooth out price data and identify trends over time. The two most commonly used moving averages are the Simple Moving Average (SMA) and the Exponential Moving Average (EMA). SMA gives equal weight to each data point, while EMA puts more weight on recent data, making it more responsive to price changes. A Moving Average Crossover occurs when two moving averages with different periods intersect on a stock's price chart. The best MA crossover strategy is the one combined with the MACD indicator for confirmed bullish or bearish signals.

Using Smart Karobaar App for MA Crossover Strategy

-

Setting up Moving Averages: To apply the MA crossover strategy, launch the Smart Karobaar App, and select the desired stock's chart. Choose the "Indicators" option, and then select "Moving Average." Set two moving averages of different periods - one short-term and the other long-term.

-

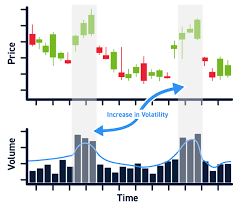

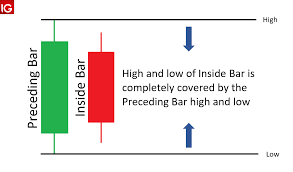

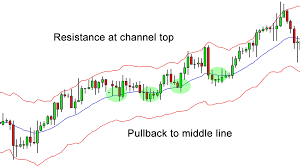

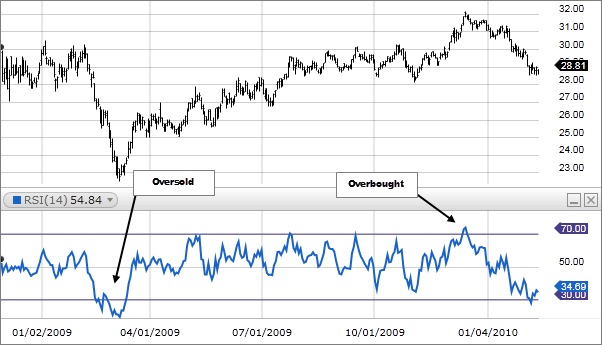

Interpreting Crossover Signals: As the stock's price data unfolds on the chart, observe the points where the two moving averages intersect. A "Golden Cross" is generated when the short-term MA crosses above the long-term MA, indicating a bullish trend. Conversely, a "Death Cross" is generated when the short-term MA crosses below the long-term MA, indicating a bearish trend.

-

Confirming Signals with Other Indicators: While MA crossovers can be reliable, it is always prudent to confirm signals with other technical indicators like Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), or Stochastic Oscillator. The Smart Karobaar App offers a wide range of technical indicators to supplement your analysis.

-

Risk Management and Stop Loss: No trading strategy is foolproof, and managing risk is crucial. Determine your risk tolerance and set appropriate stop-loss levels to protect your capital from significant losses.

-

Practice with Virtual Trading: If you are new to MA crossovers or trading in general, use the Smart Karobaar App's virtual trading feature to practice without risking real money. This will help you gain confidence and expertise before diving into live trading.