Glossary / Terminology

Understanding the basic terms and acronyms of a trading platform is essential for any beginner trader. Whether you are looking to invest in stocks, mutual funds or other securities, you need to know the language used in the world of trading to make informed decisions. In this blog post, we will define some of the most commonly used terms in trading.

Glossary ( Terms used in stock market)

- Arbitrage: It is buying and selling the same security on different exchanges and at different prices. The goal is to pocket the difference between the prices as profit.

- Averaging Down: It is adding to a losing position at a lower price to lower the average purchase price. However, this strategy is not recommended as cutting losses quickly is often the best approach.

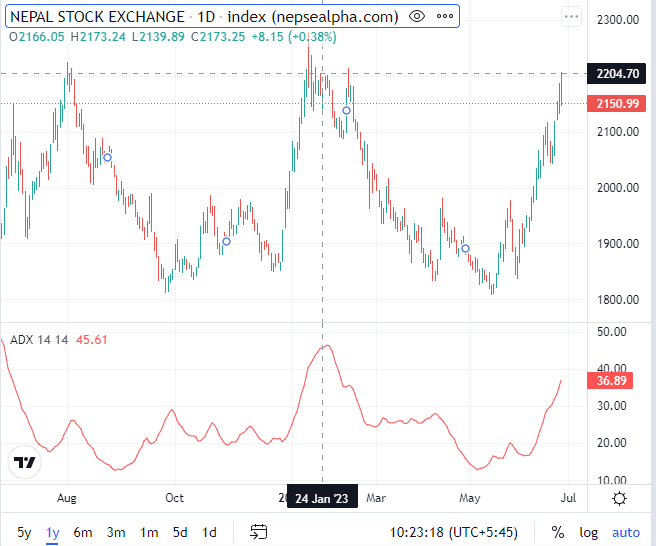

- Bear Market: A market environment where a major index or stock falls 20% or more from its recent highs.

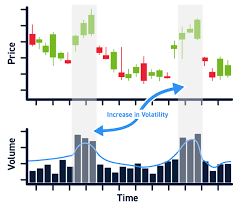

- Beta: A measurement of a stock's volatility compared to the overall markets. The markets have a beta of 1. If a stock has a beta of 1.5, it means that for every 1-point move in the market, the stock moves 1.5 points.

- Bull Market: A market in a prolonged period of increasing stock prices at least 20% above a recent low.

- Broker: A firm or person who executes buy and sell orders for stocks or other securities.

- Bid: The amount of money a trader is willing to pay per share for a stock.

- Close: The time the market closes, usually at 3 p.m. (GMT +5.45)

- Day Trading: The practice of buying and selling a stock or security within the same trading day.

- Dividend: A portion of a company's earnings paid to shareholders quarterly or annually.

- Exchange: A place where investors and traders buy and sell stocks.

- Execution: When a buy or sell order completes.

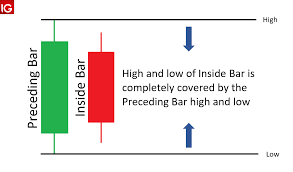

- High: A stock or index reaching a greater price point, which can be a bullish signal for traders.

- Index: A benchmark used as a reference marker for traders and investors.

- Initial Public Offering (IPO): The first sale or offering of a stock by a company to the public.

- Leverage: Borrowing capital from a broker with the goal of increasing profits, which also increases losses. This is a risky strategy.

Glossary ( Terms used in Nepse / Nepal stock market )

-

TMS: Trading Management System: A software application that allows traders to manage their trading activities, including monitoring their portfolio, placing orders, and analyzing market data.

- NOTS: NEPSE Online Trading System: An electronic trading system that allows investors to buy and sell securities online in the Nepal Stock Exchange (NEPSE).

- DNA : Direct NOTS Access: A secure login credential for NEPSE Online Trading System users that provides direct access to the trading platform.

- LTP : Last Traded Price: The price at which the last trade was executed for a particular security.

- CLI : Client: A person or organization that opens an account with a brokerage firm to buy and sell securities.

- CNC : Cash & Carry: A type of trading where the investor buys the security in full and holds it in their account until they decide to sell it.

- OTP : One Time Password: A security measure used by trading platforms to authenticate a user's identity during the login process.

- LMT : Limit Order: An order to buy or sell a security at a specified price or better.

- MKT : Market Order: An order to buy or sell a security at the current market price.

- EQ : Equity: A type of security that represents ownership in a company.

- MF : Mutual Fund: A type of investment vehicle that pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities.

- NCD : Non-Convertible Debenture: A type of debt instrument that cannot be converted into equity shares.

- GTC : Good Till Cancel: An order to buy or sell a security that remains in effect until the investor cancels it.

- GTD : Good Till Date: An order to buy or sell a security that remains in effect until a specific date.

- AON : All or None: An order to buy or sell a security that must be executed in its entirety, or not at all.

- FOK : Fill or Kill: An order to buy or sell a security that must be executed immediately and in its entirety, or not at all.

- IOC : Immediate or Cancel: An order to buy or sell a security that must be executed immediately. If the order cannot be filled immediately, it is canceled.

- CP : Closing Price: The price at which a security is traded at the end of a trading day.

Download TMS User Manual from Here :

|

|