What are circuit breakers?

Circuit breakers are a market stabilizing mechanism designed to control the excessive fluctuation of prices in the stock market. They help prevent panic selling or buying and provide a temporary pause to the market to allow investors to analyze news and make informed decisions. A circuit breaker is triggered when the market experiences a sharp rise or fall in prices within a specified period.

How do circuit breakers work in Nepse?

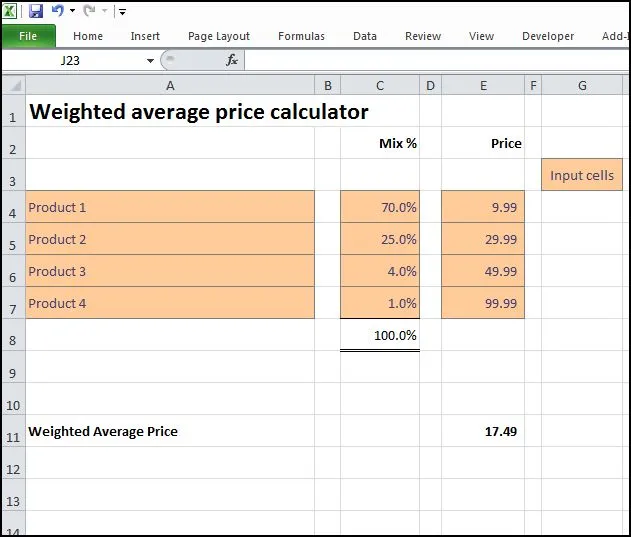

In Nepse, circuit breakers are index-based and have three levels. If the Nepse index fluctuates by 4% in the first hour of trading (i.e., before 12 PM), trading is suspended for 20 minutes. If the index fluctuates by 5% within the second hour of trading (i.e., before 1 PM), trading is suspended for another 40 minutes as a second circuit. If the index fluctuates by 6% at any point in the day, trading is suspended for the remainder of the day.

The circuit breaker rule was implemented by Nepse in 2007 to control excessive price volatility and stabilize the stock market. It has since been an essential tool in maintaining a healthy trading environment for Nepse investors.

| Movement | Time | Halt Period |

|

4% + -

|

Before 12 PM

|

20 minutes

|

|

5% + -

|

Before 1 PM

|

40 minutes

|

|

6% + -

|

Before 3 PM

|

Entire day

|

Circuit for Individual Stock

There is a concept known as circuit-level trading for individual stocks. This means that if the price of a particular company increases or decreases by 10% within a single day, it is considered to be circuit-level trading. For instance, if the price of the ABC scrip increases or decreases by 10%, it is referred to as a positive or negative circuit, respectively.

It is important to note that unlike the index-based circuit breakers, the trading of individual stocks will not be halted even if it reaches a circuit limit.

In addition to the index-based circuit breaker, individual stocks may also have circuit-level trading. This means that the price of a particular company can only rise or fall by 10% in a single day. If the price of a stock reaches its circuit limit, trading will continue, but the price of the stock will not be able to increase or decrease any further.

Why are circuit breakers important?

Circuit breakers are important because they help prevent the market from experiencing sudden and sharp price fluctuations. This can help reduce panic selling or buying and provide investors with a temporary pause to make informed decisions. It also helps maintain market stability and promotes a healthy trading environment.

In summary, circuit breakers are an essential tool for Nepse and other stock markets to control excessive price volatility and stabilize the market. By providing a temporary pause to the market, investors have the time they need to analyze news and make informed decisions, ultimately leading to a healthier trading environment.

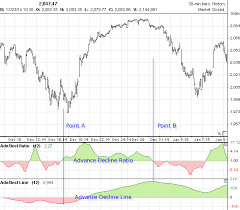

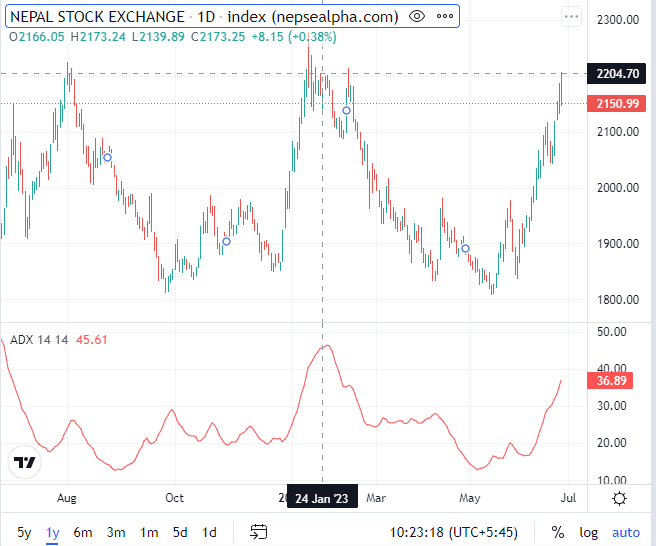

Screenshot of Circuit Break in Nepse (Date : 2021/12/14)