Organizations involved in Nepal's stock market

Nepal's stock market involves several key organizations that play important roles in the regulation, operation, and development of the securities market. These organizations work together to provide a platform for the trading of securities and financial instruments, regulate the market to ensure fairness and transparency, protect investors, promote the development of the capital market, and educate investors.

The main organizations involved in Nepal's stock market are:

-

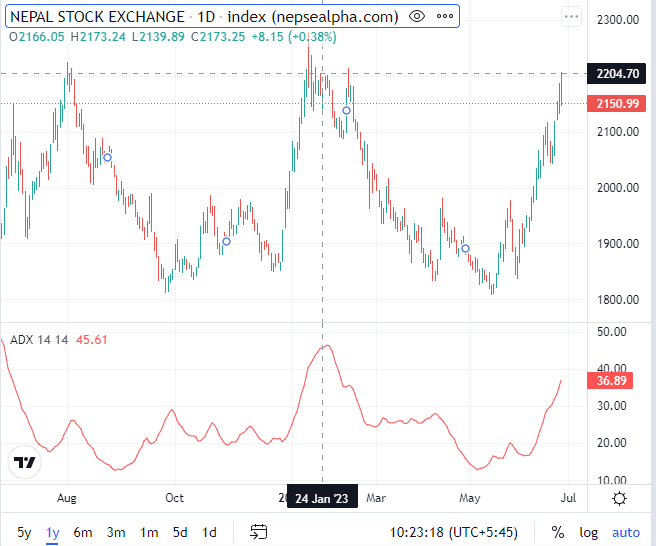

Nepal Stock Exchange Limited (NEPSE): It is the only stock exchange in Nepal and provides a platform for the trading of securities and financial instruments.

-

Securities Board of Nepal (SEBON): It is the primary regulatory body for securities markets in Nepal and regulates the operations of NEPSE.

-

Nepal Rastra Bank (NRB): As the central bank of Nepal, it also plays an important role in the regulation and development of the securities market.

-

Depository Participants: They are intermediaries between investors and depositories who facilitate the electronic settlement of securities traded on NEPSE.

-

Brokerage firms: They act as intermediaries between buyers and sellers of securities and help facilitate trades on NEPSE.

-

Investment banks: They provide a range of financial services related to securities, including underwriting, advisory, and research.

-

Other financial institutions: These include banks, insurance companies, and other organizations that invest in securities or provide related services.

What are the Functions of NEPSE?

NEPSE (Nepal Stock Exchange Limited) is the only stock exchange of Nepal. Its primary function is to facilitate the trading of securities and financial instruments. Some of the main functions of NEPSE include:

-

Providing a marketplace for the trading of securities: NEPSE is responsible for providing a platform where investors can buy and sell securities, such as stocks, bonds, and mutual funds.

-

Ensuring fair and orderly trading: NEPSE regulates trading practices and ensures that transactions are conducted in a transparent and fair manner. This includes enforcing rules on insider trading, price manipulation, and other fraudulent activities.

-

Facilitating the listing of securities: NEPSE provides a mechanism for companies, government entities, and other groups to list their securities on the exchange, allowing them to raise capital by selling shares to investors.

-

Providing market information: NEPSE disseminates information on stock prices, trading volumes, and other market data to investors, allowing them to make informed investment decisions.

-

Supporting the development of the capital market: NEPSE plays a key role in promoting the development of the capital market in Nepal by introducing new products and services, improving market infrastructure, and supporting the growth of local businesses.

What are the Functions of SEBON?

SEBON (Securities Board of Nepal) is the primary regulatory body for securities markets in Nepal. It is responsible for regulating the operations of Nepal Stock Exchange Limited (NEPSE) and ensuring that the securities market operates in a fair, transparent, and efficient manner. Some of the main functions of SEBON include:

-

Regulating the issuance and trading of securities: SEBON regulates the issuance and trading of securities in Nepal, including stocks, bonds, and other financial instruments. It sets rules and standards for the disclosure of information by issuers and requires companies to obtain approval before issuing securities to the public.

-

Supervising the activities of NEPSE: SEBON oversees the operations of Nepal Stock Exchange Limited (NEPSE) and ensures that it operates in compliance with applicable laws and regulations. It also has the authority to investigate and take enforcement action against market participants who violate securities laws.

-

Protecting investors: SEBON is responsible for protecting the interests of investors in the securities market. It sets rules on investor protection, such as rules on insider trading, market manipulation, and fraudulent activities.

-

Promoting the development of the capital market: SEBON plays a key role in promoting the development of the capital market in Nepal. It introduces new products and services, encourages innovation, and works to attract local and foreign investment to the market.

-

Educating investors: SEBON conducts investor education programs to promote financial literacy and awareness of securities market risks and opportunities. It also provides information to investors on how to invest safely and prudently in the securities market.

-

Issuing license to operate stock exchange: SEBON is responsible for issuing licenses to entities that want to operate a stock exchange in Nepal. It sets the criteria for obtaining a license and monitors the activities of licensed stock exchanges.

-

Issuing license to broker, dealer, merchant bank, and fund manager: SEBON issues licenses to individuals and entities that want to engage in securities-related activities, such as brokerage, dealing, merchant banking, and fund management. It sets the eligibility criteria and monitors the activities of licensed entities.

-

Issuing license to credit rating agency: SEBON is responsible for issuing licenses to credit rating agencies that want to operate in Nepal. It sets the criteria for obtaining a license and monitors the activities of licensed credit rating agencies.

What are the Functions of Nepal Rastra Bank (NRB)?

Nepal Rastra Bank (NRB) is the central bank of Nepal and plays a key role in the country's economic and financial system. The functions of NRB include:

-

Formulating monetary policy: NRB is responsible for formulating and implementing monetary policy in Nepal. It sets interest rates, manages the money supply, and works to maintain price stability.

-

Regulating the banking system: NRB regulates the banking system in Nepal, including commercial banks, development banks, and finance companies. It sets rules and standards for the operations of banks and works to ensure the safety and soundness of the financial system.

-

Managing foreign exchange reserves: NRB manages Nepal's foreign exchange reserves and is responsible for maintaining an adequate level of reserves to support the country's external transactions.

-

Issuing currency: NRB is responsible for issuing and managing the country's currency, including banknotes and coins.

-

Promoting financial inclusion: NRB works to promote financial inclusion and expand access to financial services in Nepal. It encourages the establishment of microfinance institutions and works to create an enabling environment for financial innovation.

-

Conducting research and analysis: NRB conducts research and analysis on various aspects of the economy and financial system, including inflation, interest rates, and banking sector performance. It publishes reports and data on these topics to inform policy and decision-making.

-

Regulating the securities market: NRB has the authority to regulate and supervise the securities market in Nepal. It works with the Securities Board of Nepal (SEBON) to ensure that the market operates in compliance with applicable laws and regulations.

-

Promoting the development of the stock market: NRB plays an important role in promoting the development of the stock market in Nepal. It introduces new policies and initiatives to encourage investment in the market and works to attract local and foreign investors.

-

Conducting research and analysis: NRB conducts research and analysis on the performance of the stock market and publishes reports and data on the market to inform policy and decision-making. It also provides guidance on market trends and risks to investors and other stakeholders.

Overall, NRB plays a critical role in maintaining the stability and growth of Nepal's economy and financial system.