NEPSE Closing Price Calculation Changed: What It Means for Investors?

Introduction

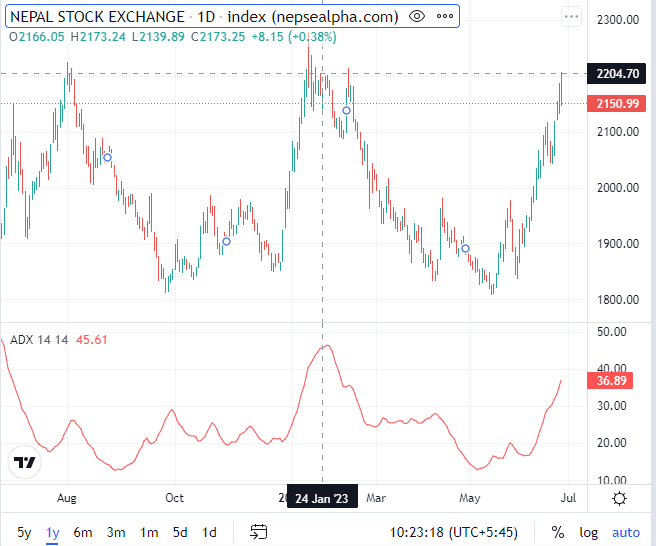

The Nepal Stock Exchange (NEPSE) has introduced a major change in how closing prices are calculated. Previously, the Last Traded Price (LTP) determined the closing price, but now, NEPSE will use the Volume-Weighted Average Price (VWAP) of the last 15 minutes of trading. This new method aims to make the market more transparent and reduce manipulation.

If you are an investor in NEPSE, it’s crucial to understand this change and its impact on your trading strategy. In this blog, we will break down the new price calculation system, its advantages and disadvantages, and its effect on retailers and operators.

How is the New Closing Price Calculated?

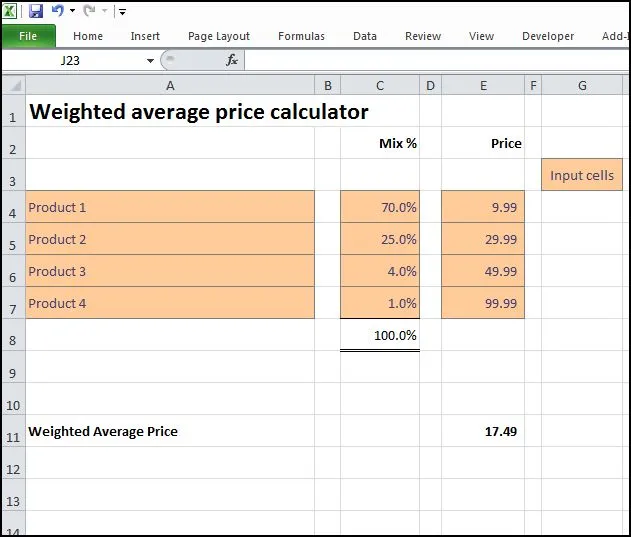

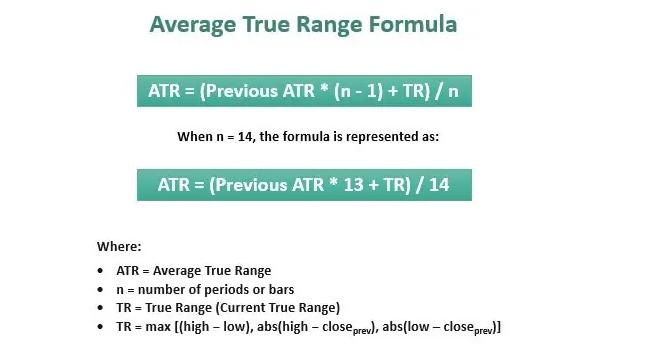

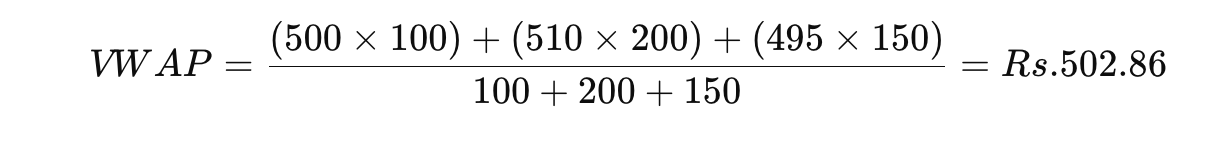

Under the new system, NEPSE calculates the closing price using the Volume-Weighted Average Price (VWAP) of the last 15 minutes of trading. The formula is:

Example Calculation:

Let’s assume three trades occurred in the last 15 minutes:

-

Trade 1: 100 shares at Rs. 500

-

Trade 2: 200 shares at Rs. 510

-

Trade 3: 150 shares at Rs. 495

Using the formula:

Thus, the closing price for the day will be Rs. 502.86 instead of the last traded price.

What is the Post-Close Market?

NEPSE has a Post-Close Market session from 3:00 PM to 3:10 PM, but it does not allow traders to buy or sell stocks. This period is solely used to determine the official closing price of the market.

Under the previous system, the Last Traded Price (LTP) during this period determined the closing price. Now, with the VWAP-based system, the closing price will be calculated using the weighted average of trades from the last 15 minutes of the regular trading session.

As per TMS vendor YCO, the system currently calculates VWAP based on a 5-minute interval, but this feature is not yet active. Since the regulation requires a 15-minute VWAP, the system will soon be updated and tested to align with the new rules at the earliest convenience.

This update is expected to enhance market stability and transparency by ensuring that the closing price reflects a broader range of trades instead of a single last transaction.

Advantages of the VWAP-Based Closing Price

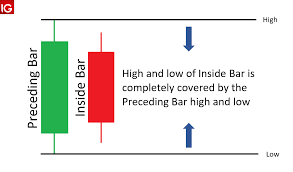

✅ Reduces Market Manipulation

Previously, operators could manipulate the closing price by executing a small trade at an artificial price in the last second. With VWAP, the closing price reflects the average traded price over 15 minutes, making manipulation harder.

✅ More Accurate Market Representation

VWAP considers both price and volume, making it a better representation of the stock’s fair value. It reduces price distortion from one-off trades.

✅ Aligns NEPSE with Global Standards

Stock exchanges in India, the US, and other countries use similar VWAP-based closing price methods, improving transparency and investor confidence.

Disadvantages of the VWAP System

❌ Increased Volatility in the Last 15 Minutes

Since the closing price depends on trades in the last 15 minutes, trading activity might surge during this period, increasing short-term volatility.

❌ Complexity for Retail Investors

Many Nepali traders are used to simple LTP-based closing prices. Understanding VWAP may require additional learning.

❌ Operators Can Still Influence the Price

Although manipulation is harder, operators with high capital can place large trades in the last 15 minutes to influence the VWAP closing price.

How Will This Change Affect Retail Investors?

For small investors, the new system is mostly beneficial because it prevents artificial price inflation. However, traders must now pay closer attention to market trends and volume in the last 15 minutes to make better decisions.

If you are a retailer, here’s what you should do:

-

Monitor trading activity in the last 15 minutes to predict the closing price.

-

Use VWAP as a benchmark to decide whether to enter or exit trades.

-

Avoid panic buying/selling in the last 15 minutes, as prices may be volatile.

What About Operators and Big Investors?

For big investors and operators, the new system requires strategic adjustments.

✅ Benefits for Operators:

-

They can now plan bulk trades strategically instead of making a single trade at the last second to manipulate the closing price.

-

Algorithmic trading strategies based on VWAP can be used to execute large orders efficiently.

❌ Challenges for Operators:

-

Direct manipulation is more difficult.

-

They must distribute trades over the last 15 minutes to influence the closing price rather than a single transaction.

Can the Market Still Be Manipulated?

While the VWAP system reduces price manipulation, operators might still attempt to manipulate the closing price by:

-

Placing large buy/sell orders in the last 15 minutes to push the VWAP up or down.

-

Engaging in wash trading (buying and selling among themselves) to create false volume.

However, NEPSE has surveillance systems to detect such activities, and market regulators may impose penalties on those engaging in manipulation.

Conclusion: Is This a Good Change?

The transition to a VWAP-based closing price is a positive step for the Nepalese stock market. It reduces last-minute manipulation, provides a more accurate closing price, and aligns NEPSE with global trading practices.

For retail investors, this is a good change, as it makes stock prices more stable. For big investors and operators, new strategies will be needed to adjust to the VWAP-based system.

Final Takeaways:

✅ Watch the last 15 minutes of trading closely. ✅ Use VWAP as a benchmark for better trading decisions. ✅ Avoid being influenced by short-term price fluctuations.

Do you think this change will improve the NEPSE market?